Jan. 25, 2010 – For more than a year, the government pulled out the stops to revive homebuying by driving down mortgage rates.

Now, whether the housing market is ready or not, the government is pulling out.

The wind-down of federal support for mortgage rates, set to end in two months, is a momentous test of whether the Obama administration and the Federal Reserve have succeeded in jump-starting the housing market and ensuring it can hold its own. The stakes for the economy are massive: If the market again falls into a tailspin, homeowners could face another wave of trouble, and it would deal a body blow to President Obama’s efforts to get the economy on track.

Keeping the mortgage rates at historic lows, which required a commitment of more than $1 trillion, was viewed within the administration as a central plank of the economic strategy last year, senior officials said. Though the policy did not attract as much attention as rescue efforts to bail out banks, it helped revitalize homebuying in some parts of the country and put money in the pockets of millions of homeowners who were able to refinance into lower monthly payments, the officials added.

“We did what we thought was necessary to stabilize the market, but we don’t think the government should continue special efforts forever,” said Michael S. Barr, an assistant secretary at the Treasury Department. “As you bring stability, private participants come back in. We do expect this now that the market has stabilized. I’m not going to say there will be no effect on rates, but we do think you are seeing market signs and market signals that there should be an orderly transition.”

A few federal officials and many industry advocates disagree, saying the government is exiting too soon. They offer dire warnings of higher rates and a slowdown in home sales. Fed leaders say they will end a marquee program supporting the mortgage markets in March. Obama’s economic team, led by Treasury Secretary Timothy F. Geithner, has decided not to replace it and has been shutting down its own related initiatives.

Over the past year, these programs have enabled prospective homebuyers to get cheap loans, helping those buying and selling property as well as those eager to refinance existing mortgages. If the end of the initiative drives up interest rates, say from 5 percent to 5.5 percent, homeowners could be deterred from refinancing, industry officials say. A sharper increase in rates could make homes too expensive for many buyers, forcing them from the market and causing the recent pickup in home sales to stall.

“Mortgage rates are the lifeblood of the housing market, and we have cautioned the Fed about the sudden stoppage of this program,” said Lawrence Yun, chief economist of the National Association of Realtors.

But senior government officials said it could be hard to reverse course without damaging the credibility of the Fed and the administration. If the government loses the trust of the financial markets, preparing them for policy changes could be tougher, possibly resulting in economic disruptions. The officials said they also worry that the mortgage market is becoming overly dependent on federal support, inserting the government too deeply into private enterprise.

Only a new crisis would be able to persuade the administration and the Fed to change their minds, officials said.

“This is a worthy experiment to see if they can begin exiting after providing an unprecedented amount of money to one sector of the economy,” said Mark Zandi, chief economist at Moody’s Economy.com. “It’s a close call, though. I can see why they are debating it.”

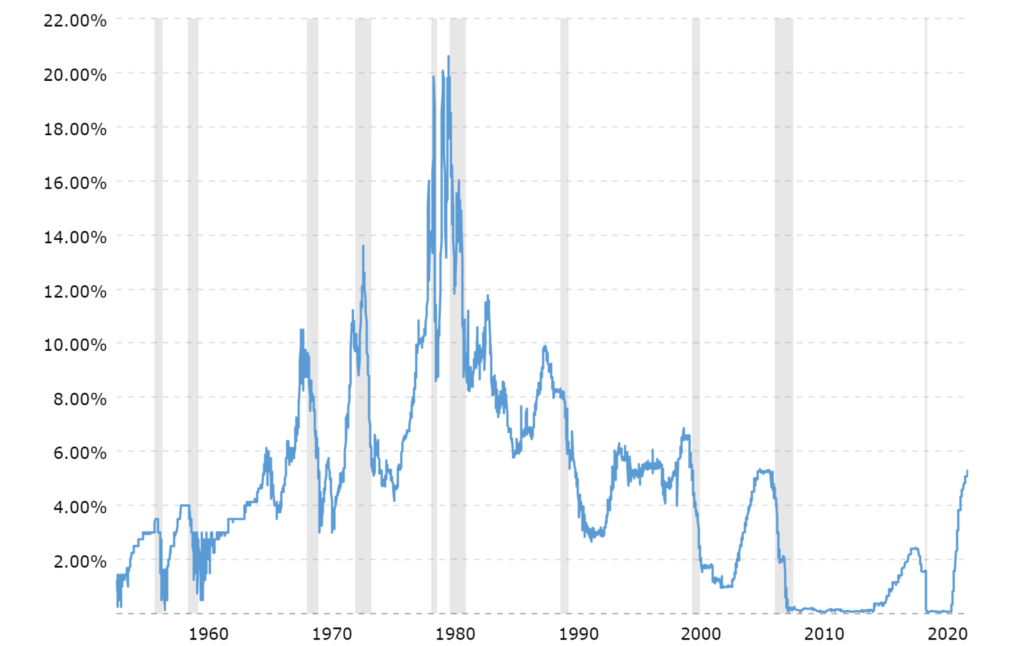

The Fed’s policymaking body sets a key interest rate at periodic meetings, which in turn influences rates for all kinds of loans. But mortgage rates also are shaped by the health of the market financing these loans.

Banks typically create giant pools of home loans and turn them into securities that can be traded on the open market. When the system is working, many investors buy these mortgage-backed securities, providing a stream of money for lenders so they can make loans at relatively cheap rates. But the trading of these securities seized up when the financial crisis struck and panicked investors. Government officials feared that the mortgage market would collapse.

The Fed and the Treasury stepped into the breach, becoming the only major buyers of these mortgage-related securities, and they kept the mortgage market flush with cash. The Treasury spent about $220 billion, and the Fed pledged $1.25 trillion, the single largest foray the central bank has made into the markets since the onset of the crisis. In essence, the Fed has been printing money and funneling it to people looking to buy a house or refinance an existing mortgage.

At the same time, the federal government stood behind mortgage-finance companies Fannie Mae and Freddie Mac by taking them over and pledging to cover their losses. That helped the firms lower borrowing costs, since lenders know they can’t fail, and the companies passed on their savings to mortgage borrowers in the form of low rates.

Combined, these federal efforts helped push down the rates ordinary Americans pay for a mortgage. The 30-year fixed-rate mortgage declined from 6.04 percent in November 2008, according to Freddie Mac data, and hit an all-time low of 4.71 percent about a year later.

Refinancings surged, while homebuying perked up. Existing-home sales climbed nearly 10 percent in September, their highest level in more than two years.

The policy was the government’s most effective salve for the ailing housing market at a time when other initiatives, such as the administration’s attempts to modify the mortgages of struggling homeowners, produced far more disappointing results.

Now the government wants to end its support for low rates and has been striving to persuade others to buy mortgage securities.

The success of this approach hinges on the willingness of private investors, from China to big Wall Street funds, to buy large amounts of the mortgage securities and fill the void left by the government.

On Christmas Eve, Treasury officials announced a move that would cover losses suffered by investors who buy these securities from Fannie Mae and Freddie Mac, which together now back about half of the nation’s $12 trillion mortgage market. The goal was simple, officials said. They wanted private investors to be reassured that mortgage securities are safe to buy.

As the economy showed signs of recovery at the end of last year, the administration and the Fed decided to end their support.

The Treasury stopped buying mortgage securities in December. The Fed said it would taper off purchases gradually, ending them by March 31.

Obama’s economic team could have raised the limits on how much mortgage securities Fannie and Freddie can buy, allowing those firms to replace the Fed’s purchasing program. But Barr said the administration thinks the mortgage business will stand on its own without such special assistance, similar to the way the nation’s biggest banks weaned themselves off federal bailout funds by raising private capital.

“The basic goal is to implement a gradual process where the government’s role in the economy goes down,” Barr said. “It has to be consistent with the basic goal of stability, but it is appropriate.”

Administration and Fed officials expressed confidence that rates will rise only modestly – perhaps a quarter of a percentage point. They attribute their optimism to the lengthy notice they have given the market. The markets already should have anticipated the government’s exit by adjusting interest rates higher. Yet mortgage rates have been falling slightly the past few weeks.

The optimism at the White House and the Fed, however, is not shared across the government. A few senior policymakers at the central bank view the economic recovery as still too fragile, suggesting that purchases perhaps should expand further. These dissenters also warn that mortgage rates could shoot up, perhaps to 6 percent or higher, because private investors buying securities would demand a greater rate of return than the Fed. To reach it, lenders may have to raise rates for consumers.

“Presumably, there is pent-up demand from the private sector, but the question is: At what rate are they going to be interested?” said Eric S. Rosengren, the president of the Federal Reserve Bank of Boston, who has indicated that he supports expanding the Fed’s mortgage securities purchase program.

There also could be unintended consequences to the government’s pull-out. Last year, big investors such as Pimco sold their mortgage-backed securities to the government and used that money to buy bonds and stocks. That extra cash, which propped up stock prices, could drain away after federal support ends.

Real estate and mortgage finance officials said the timing of the government’s exit seems especially ill-conceived, since the Fed’s support would end just a month before a homebuyer tax credit program, which the real estate industry has credited with jump-starting home sales.

Given the importance of the housing market, some industry officials doubt whether the government will follow through with its pledge to exit the mortgage market in March. Fannie and Freddie officials say that the companies together can buy about $300 billion of mortgage securities by the end of the year before they hit their federally mandated limits. Though it appears reluctant to do so, the administration could use that buying power to cushion the blow after the Fed’s program ends, the industry officials said.

“I believe they do want to end it in March, but it’s like all New Year’s resolutions,” said Mark Vitner, a senior economist at Wells Fargo Securities. “The Fed’s New Year resolution is to go on a diet, go to the gym, give up drinking and clean the garage. They might be able to do one of those things, but to do all four is tricky. They have to drain all the liquidity they added to the financial market so we don’t see a resurgence in inflation, but do it in a way so that the economy does not slip into recession.”