July 2024 Real Estate Market Update for Pinellas County

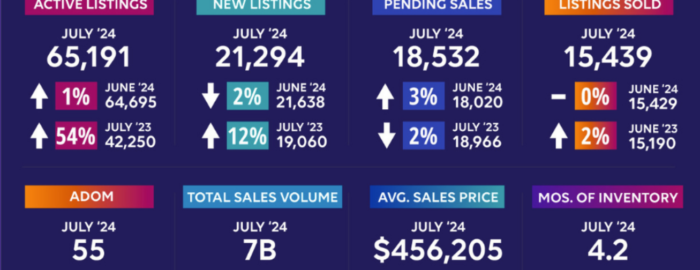

The latest data from Steller MLS reveals some intriguing trends in the Pinellas County housing market. The number of active homes for sale has increased by just 1% over the past month, but compared to July 2023, active inventory is up by a significant 54%. This expansion in inventory is great news for buyers, who now have more options to choose from. Over the past four years, limited inventory and fierce competition forced buyers to make quick decisions. While competition persists in certain price ranges, particularly for homes under $700,000 or those updated in high-demand areas, the market dynamics are shifting.

Demand in the housing market has slowed, largely due to higher interest rates and the anticipation of potential rate cuts by the Federal Reserve. Many buyers appear to be holding back, waiting to see how the situation unfolds. This cautious approach could be beneficial—or it could lead to missed opportunities. To illustrate, when the COVID-19 pandemic hit and the Fed slashed rates to 0.25%, mortgage rates dropped to below 2.8%. This made homes more affordable, causing prices to surge nationwide, not just in states where buyers flocked. For example, a $400,000 home at a 5% interest rate would have a monthly principal and interest payment of $2,150. At a 2.8% rate, that same payment could afford a $525,000 home, explaining the rapid increase in home prices during that time.

So, what can we expect when interest rates eventually come down? Will home prices decrease, or will they rise again?

In July, new listings entering the market cooled by 2% compared to the previous month but were up 12% from July 2023. Pending sales increased by 3%, and while the number of sold homes remained flat compared to June, it was up 2% year-over-year. The average days on market decreased by 2% from the previous month but increased by 38% compared to last year, reflecting the growing inventory and the choices buyers now have.

Interestingly, the average sales price dropped by 5% compared to last month but is up 1% from a year ago. This could explain the slowdown in activity, as buyers anticipate further price reductions. However, it’s essential to consider the broader context: with over 60% of homeowners holding mortgages with rates below 3%, many sellers are staying put, enjoying their low rates. Until interest rates drop to a level that makes moving financially viable, these homes are unlikely to hit the market, keeping inventory tight.

What Should You Do if You’re Looking to Enter the Pinellas County Real Estate Market?

The answer depends on your situation. If you only plan to stay in your home for 1-2 years, it might be wise to wait unless you’re open to renting the property after you move. However, if you’re planning to stay long-term, history suggests that buying now could be a smart move. You could potentially refinance as rates decrease to levels similar to what we’ve seen over the past 10-15 years (around 4% to 5.5%).

Interested in a Personal Consultation?

Call Price Group Realtors at 727-851-6189 to discuss your real estate needs.