Mortgage interest rates have always been a crucial factor for homebuyers, influencing their purchasing power and the overall cost of homeownership. Over the past three decades, these rates have seen significant fluctuations, reflecting broader economic trends and policy changes. Today, as we see rates around 6.9% for a 30-year fixed mortgage, it’s helpful to put this into historical context and understand what it means for prospective homebuyers.

Historical Mortgage Rates: A 30-Year Overview

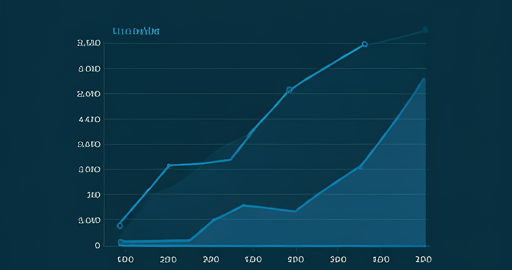

To appreciate the current mortgage rates, let’s take a look at their trajectory over the past 30 years. Historically, mortgage rates have varied widely:

**1990s:** Mortgage rates in the early ’90s started high, around 10%, but gradually decreased to about 7% by the end of the decade.

**2000s:** Rates fluctuated between 5% and 7%, impacted by the economic boom and subsequent recession.

**2010s:** The aftermath of the 2008 financial crisis led to historically low rates, often below 4%, with a significant dip in 2020.

**2020-2023:** The COVID-19 pandemic caused rates to plummet to unprecedented lows, with averages around 2.875% in 2020. However, rates began to climb again due to inflation and economic recovery efforts.

To put today’s rate of 6.9% in perspective, we can compare it to the average rate over the past 30 years, which hovers around 5.5%.

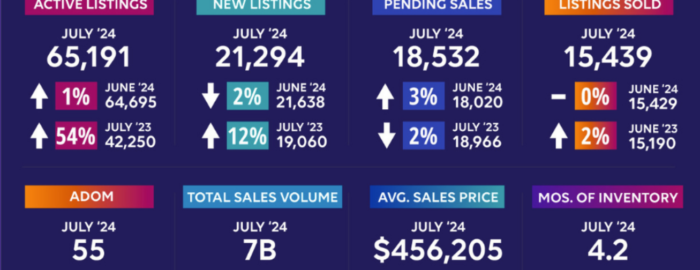

The Impact on Home Prices: Pinellas County Case Study

Let’s consider a typical homebuyer in Pinellas County, where the average home price is currently around $460,000. How do different mortgage rates affect the affordability of such a home?

1. **Today’s Rate (6.9%):**

– **Home Price:** $460,000

– **Loan Amount (assuming 20% down payment):** $368,000

– **Monthly Payment (excluding taxes and insurance):** Approximately $2,431

2. **Low of 2020 (2.875%):**

– **Home Price:** $460,000

– **Loan Amount:** $368,000

– **Monthly Payment:** Approximately $1,529

3. **30-Year Average Rate (5.5%):**

– **Home Price:** $460,000

– **Loan Amount:** $368,000

– **Monthly Payment:** Approximately $2,092

As evident, the mortgage rate significantly impacts the monthly payment. At today’s rate of 6.9%, the monthly payment is substantially higher compared to the lows of 2020 and the 30-year average. This underscores the importance of timing in the real estate market and the benefits of securing a lower mortgage rate.

Visualizing the Trends

For a detailed visual representation of mortgage rates over the past 30 years, you can refer to this comprehensive chart provided by Freddie Mac

Conclusion

Understanding the history of mortgage rates can help prospective buyers make informed decisions. While today’s rates are higher than the historical average, they are still lower than the peaks seen in the early ’90s. For those looking to buy in Pinellas County or elsewhere, keeping an eye on economic trends and mortgage forecasts is crucial for maximizing affordability and securing the best possible rate.

Advice for Homebuyers: Should You Buy Now or Wait?

Navigating the housing market can be challenging, especially with current mortgage rates around 6.9%. Many prospective buyers are left wondering whether it’s better to buy now or wait until rates potentially drop. Here’s a strategic look at the options:

Buying Now and Refinancing Later

With the Federal Reserve predicting that mortgage rates could decrease to around 5% by 2026, one strategy is to purchase a home now and plan to refinance when rates drop. Here are the pros and cons:

Pros:

- Locking in Current Home Prices: Home prices in Pinellas County are rising by about 3% annually. Buying now allows you to lock in today’s prices before they potentially increase further.

- Building Equity: By purchasing a home now, you start building equity sooner, which can be advantageous when refinancing.

- Homeownership Benefits: Enjoy the benefits of homeownership, such as stability, potential tax deductions, and the freedom to personalize your space.

Cons:

- Higher Initial Payments: With current rates at 6.9%, your monthly mortgage payments will be higher initially, impacting your budget.

- Refinancing Costs: Refinancing involves additional costs, such as closing fees, which need to be considered.

Waiting for Rates to Drop

Another approach is to wait until mortgage rates potentially decrease to around 5% by 2026. Here are the pros and cons of waiting:

Pros:

- Lower Monthly Payments: Waiting for lower rates means potentially lower monthly mortgage payments, making homeownership more affordable.

- Reduced Interest Over Time: Lower rates mean you’ll pay less in interest over the life of the loan, saving money in the long term.

Cons:

- Rising Home Prices: As home prices are expected to increase by about 3% annually, the cost of homes will be higher in a few years. For example, a home priced at $460,000 today could cost around $502,000 in 2026.

- Missed Equity Growth: By waiting, you miss out on several years of potential equity growth and homeownership benefits.

Making the Decision: Factors to Consider

- Financial Readiness: Assess your current financial situation. Do you have a stable income, sufficient savings for a down payment, and a good credit score?

- Market Conditions: Keep an eye on market trends and economic forecasts. If home prices are rising steadily, the benefit of lower rates may be offset by higher purchase prices.

- Personal Circumstances: Consider your personal and family needs. If you need a home now due to life changes, waiting might not be practical.

Conclusion

Deciding whether to buy now or wait is a personal choice that depends on various factors, including your financial readiness, market conditions, and personal circumstances. Buying now with the intention to refinance later can be a viable strategy, especially in a market with rising home prices. However, if you can afford to wait and anticipate lower rates, it might be worth considering. Consulting with a financial advisor or real estate professional can provide tailored advice to help you make the best decision for your situation.