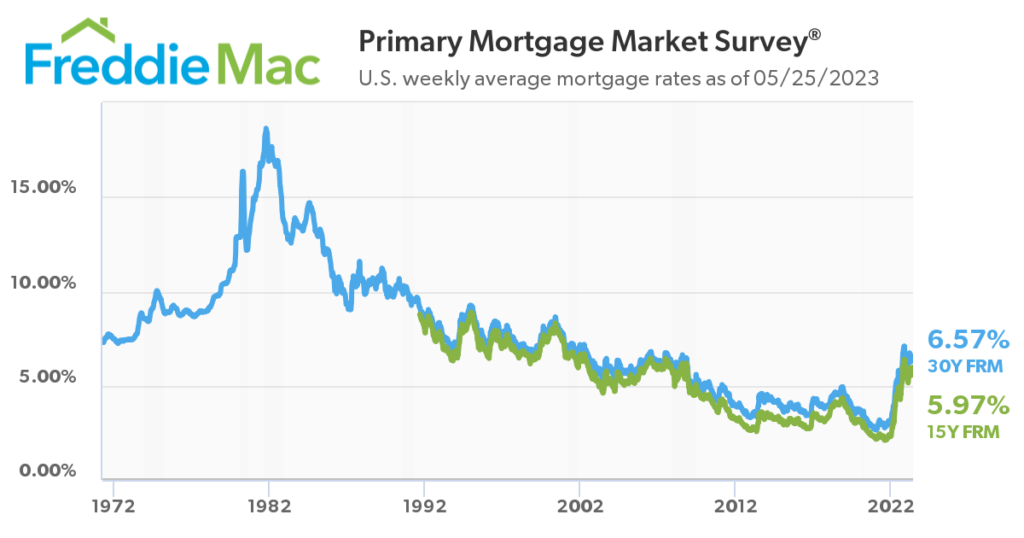

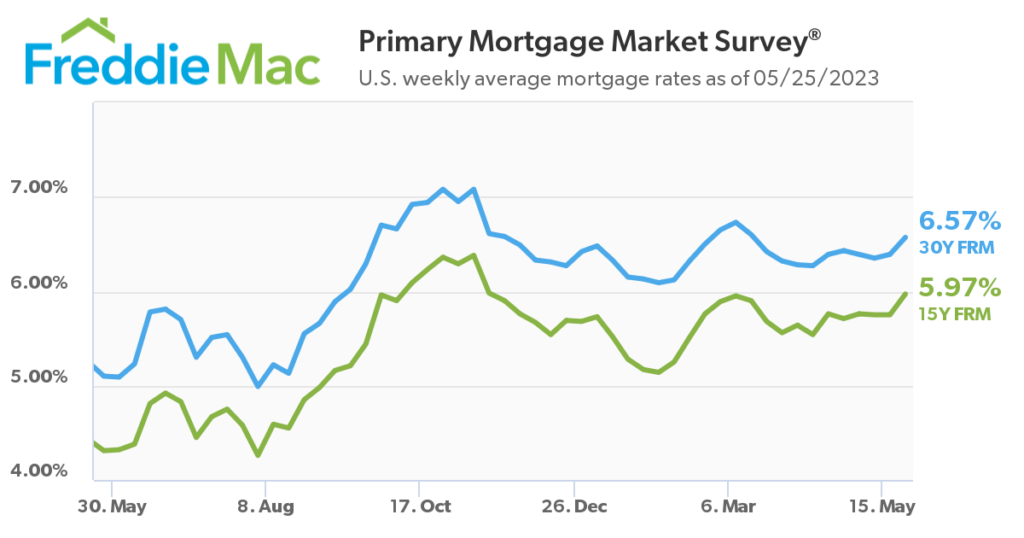

Impact on Real Estate Prices: The Federal Reserve’s interest rate decisions have a significant impact on the real estate market. When the Fed raises interest rates, mortgage rates tend to follow suit, leading to higher borrowing costs for homebuyers. As a result, potential homeowners may find it more challenging to afford a mortgage, leading to a slowdown in housing demand.

During periods of rising interest rates, existing homeowners with adjustable-rate mortgages may also experience higher monthly payments, potentially causing some to sell their homes or face challenges in meeting their financial obligations.

Additionally, real estate investors who often rely on borrowing to finance property acquisitions might be deterred by higher interest rates, potentially leading to a decline in investment activity in the housing market. However this hasn’t happened in Florida as of July 2023. With such strong demand for housing as Buyer move into the state and rental prices hitting new highs, home prices have been increasing.

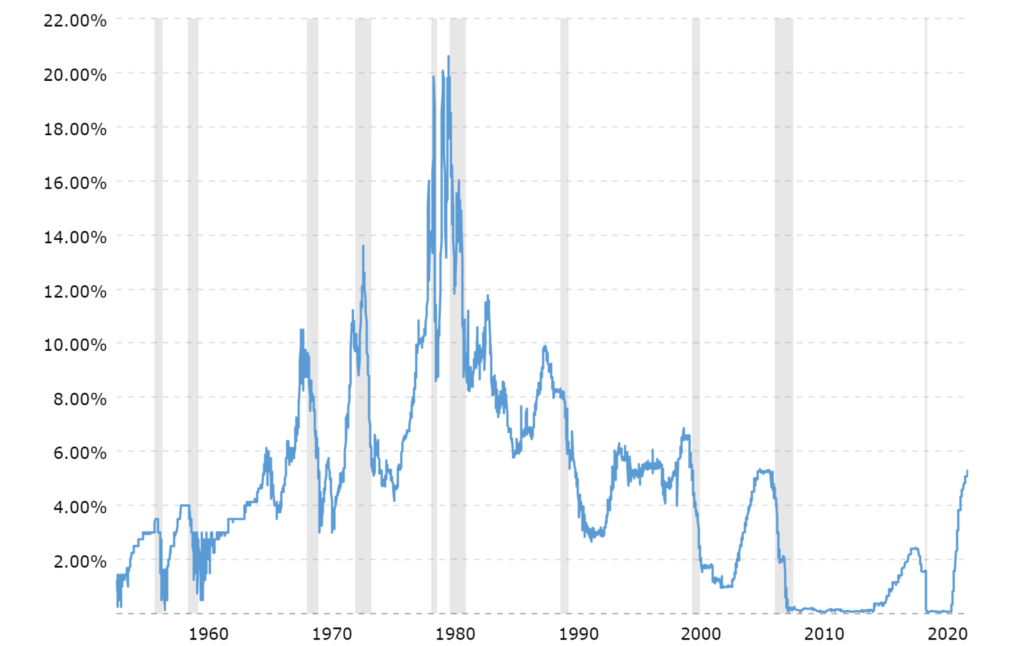

Real Estate and Economic Cycles: The real estate market is closely tied to the overall health of the economy. When the Federal Reserve raises interest rates to combat inflation or an overheating economy, it can trigger economic slowdowns or recessions, as mentioned earlier. These economic contractions can have a pronounced impact on the real estate sector.

During recessions, demand for housing typically weakens as consumers become more cautious about making significant financial commitments. As a result, home sales can decline, and property prices may stagnate or even decline in some areas.

Fed’s Response and Real Estate Stimulus: As the economy faces the repercussions of higher interest rates and potential economic downturns, the Federal Reserve often takes measures to stimulate economic activity, including the real estate market.

In response to recessions, the Fed tends to lower interest rates to make borrowing more affordable. Lower mortgage rates can entice buyers back into the housing market, helping to bolster demand and support property prices.

Additionally, during severe economic downturns, the Federal Reserve might implement quantitative easing, which involves buying financial assets, including mortgage-backed securities. This injection of liquidity into the financial system can further lower mortgage rates, providing additional support to the real estate market.

Conclusion: The Federal Reserve’s interest rate decisions have a cascading effect on the real estate market, with implications for both homebuyers and investors. Higher interest rates can lead to reduced housing demand and potentially weigh on property prices. Conversely, lower interest rates enacted during economic downturns can help stimulate housing activity and contribute to the recovery of the real estate sector.

As the Federal Reserve navigates its monetary policy decisions, it must consider the interplay between interest rates, economic cycles, and the real estate market. Striking a delicate balance is essential to avoid overshooting rate increases and causing undue strain on the housing sector. An adept understanding of historical patterns and lessons learned can help guide the Federal Reserve in supporting a stable and sustainable real estate market amidst broader economic fluctuations.

If you review the chart above, you will notice a trend in relations to rate hikes and the start of a recession then rate cuts, I feel like all other times the FED has also gone too far with it’s rate hikes and so does the financial markets, with expectations that the FED will reduce rates early 2024 if not at the end of 2023 depending on data. If this happens we will see home prices push up with buyers who have been sitting on the side lines making a move. We might also see Seller who have been enjoying sub 3% mortgage rates make a move which will release inventory to a market which is in desperate need.

Our advice would be to buy your dream home now if you can afford it! and refinance when the rates come down more then 1% or more in the next 12-18 months.

If your ready to make a more now search for a home by “clicking here”